Company Car Lease Tax Benefits India

Being Indias first car leasing portal SalaryPlan is a one stop market. India Business News.

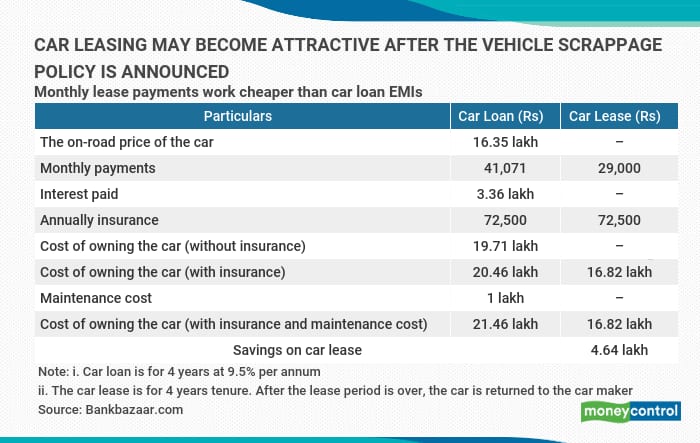

Vehicle Scrappage Policy Leasing Is A Cheaper Option Than Buying A Car On Loan Now

Leasing vs buying a car.

. The lease amount you pay for a vehicle is eligible for tax relief. Only Rs 2700 pm. Unlike home loan you can not claim interest payments as tax deduction in car loan.

In a financial lease plan which is the same as a rental lease plan except that the leasing company will sell the car to you. Right now you can use the BankBazaar website to lease a car from Revv. This is applicable for self-employed as well as salaried professionals.

We have to look at how much we are saving and stop looking at how much the lease company is makingall the best. You dont have to buy it to own it. When an employer talks about your salary they mean your basic starting salary.

- Instead of car loan - you can take a car lease. Full funding of the car value is available with SMAS India and the employees are not required to make any down payment to opt for the car under company car lease policy Tax Saving All the eligible employees would be able to save taxes to the extent of the lease rentalEMI paid by them against their car. Driving a company car.

These cars are taken on lease by the company and used by the employee both for official as well as personal purposes. We recommend that you ask your employer and get car lease from the employer for tax optimization. Employees are often confused about the taxability tax benefits of owning a.

In case you lease a car you wont be owning it and may feel low in a society where your near and dear ones might own a car and you drive a rented vehicle. The actual amount paid by the employer less Rs 1800 a month would be the amount considered as a perk for cars with an engine capacity below 16 litres. In such case the EMI paid by your employer to the leasing company is deducted from your monthly salary resulting in reduction in your taxable income.

16 litres and Rs 3300 pm. As previously mentioned business leasing can provide considerable tax benefits. This means if Rs 5000 per month is spent excluding driver on a small car then Rs 3200 would be added to the income of an individual owning the vehicle.

With low registration tax and for company cars therefore also with a low tax value. The lease plan also works well only if you fall in the 30 tax bracket because if you are paying Rs 30000 per month as car lease then you clearly save Rs 9000 per month on tax 30 of Rs 30000. Above 16 litres will be added as perquisite for car and driver in your taxable.

Leasing a vehicle could help you save as much as 30 on your taxes. SalaryPlan is a unique car leasing solution that offers a tax efficient flexible and a convenient car acquisition method for employees. Car lease options in your city.

Leasing a car differs from a commercial hire purchase under which the interest and depreciation is tax deductable. Large corporate companies from across sectors are availing of our car leasing service all over India for managing their vehicle and car fleet requirements - corporate car lease services like tool for trade cars on lease for their field staff perk cars on lease for senior management and tax saving company cars on lease for their employees SME. Answer 1 of 3.

If your employer provides you with a car lease option you should consider availing of the same as it would be a tax efficient option. Buying a car is not like buying other things in India. These are additional benefits or incentives like house rent.

In this car though will be registered in lease company but the rentals you pay can be claimed as an expense For salaried - there are no benefits from income tax per se. Keeping in mind the tax savings over period of 36 or 48 months lease plan is better option Even if you are paying 120 for say 3 yrs it is nothing but 7 annualized interest but you might have saved 30 on tax and still 23 over all saving. With the amendment of the Registration Tax Act at the end of 2017 the Car Package a special recalculation of the registration tax on leasing cars was introduced with a comparison and possible increase after 4 months in relation to the market price.

It also makes car policy administration hassle-free for employers. Being an owner of a car you always dreamt about is another feeling within itself. Various components are then added to this number to create your final salary package.

You can claim back up to 50 of the tax on the monthly payments of your lease up to 100 of the tax on a maintenance package and depending on the vehicles CO2 emissions costs of leasing can be deducted from taxable profits if the vehicle is considered a company car. Normally we have seen a lot of salaried employees having several queries about the tax liability of owing a car and using it for both personal and office use. Thus your total expenditure is 1037803.

Leasing company car is more tax efficient than owning a car for salaried employees. In case the car is used partly for office purpose and partly for self use its tax efficient to have car on company lease instead of owning a car. But leasing means you get a tax benefit of up to 30 which is nearly 4 45000 over the course of four years.

As individual car lease hits mass market brands including Hyundai Toyota Mahindra and Fiat auto marketers are targeting self-employed and professi.

Leasing Vs Buying A Car Which Is The Practical Choice

Is There Any Tax Benefit For Availing A Company Car Lease Under The New Tax Regime Quora

Gst On Car Lease Current Market For A Car Lease In India Legodesk

Komentar

Posting Komentar